Weekly financial update from The Miller FInancial Group, a financial advisor serving Boca Raton, FL and beyond.

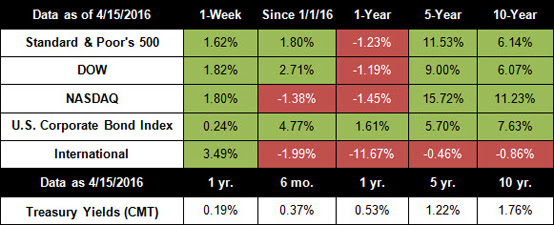

Stocks rallied again last week on better-than-expected earnings and some reassuring news about China’s economy, giving the Dow its best weekly performance since mid-March.[1] For the week, the S&P 500 gained 1.62%, the Dow added 1.82%, and the NASDAQ grew 1.80%.[2]

Earnings reports are trickling in and the news so far is not as bad as expected. Since advance estimates had prepared investors for very weak earnings reports, the weak reports we’re seeing are being treated as victories. Out of 35 S&P 500 firms reporting in so far, total earnings are down 9.0% from Q1 2015 on 0.1% higher revenues with 71.4% beating their earnings estimates.[3] As earnings season continues to unfold in the weeks ahead, we may see more of the same, which could give markets room to rally. On the other hand, investors could take the weak earnings picture as a sign that the economy is struggling to produce sustainable growth.

After months of gloom on China’s economy, a new report shows that China’s economy grew 6.7% in the first quarter. Though this is down from the fourth quarter’s 6.8% rate of growth, it’s not as bad as investors had feared. U.S. investors treated the news as a win, though China experts are skeptical about the reliability of these statistics. Since China’s ruling body has staked its political legitimacy on economic stability, officials have a lot of pressure to produce reassuring data. Overall, it’s not likely that China’s economic woes are over.[4]

The European Union gave us some headlines at the end of the week as Britain officially launched a campaign ahead of a referendum on leaving the EU on June 23rd. Current polls on a “Brexit” are evenly split with a significant number of people undecided on the issue.[5] However, if Britain were to exit the EU, it would likely have a serious knock-on effect on markets, trade agreements, and currencies.[6]

In other international news, several major oil-producing nations met over the weekend to discuss coordinating oil output to stabilize prices. If they come to an agreement, oil prices might bounce higher and offer some relief to the beleaguered energy sector; however, closing a deal between a large group of producers with widely varying national interests will be tough.[7]

The week ahead is packed with earnings reports from 101 S&P 500 companies, including heavy hitters like Caterpillar [CAT], General Electric [GE], General Motors [GM], and Yum Brands [YUM].[8] Investors will also get a look at housing market data and see how well the sector is doing during the spring real estate season.

ECONOMIC CALENDAR:

Monday: Housing Market Index

Tuesday: Housing Starts

Wednesday: Existing Home Sales, EIA Petroleum Status Report

Thursday: Jobless Claims, Philadelphia Fed Business Outlook Survey

Friday: PMI Manufacturing Index Flash

HEADLINES:

- Retail sales fall unexpectedly. U.S. retail sales dropped last month as Americans cut back on purchases of cars, trucks, and other big-ticket items. The stumble suggests economic growth likely slowed last quarter.[9]

- Weekly jobless claims fall. Weekly claims for new unemployment benefits fell by 13,000 to levels last seen in 1973. Claims for the prior week were also revised lower.[10]

- Consumer sentiment drops. A measure of consumer confidence fell for the fourth straight month last week, showing that volatility and recession talk are weighing on optimism.[11]

- Federal Reserve survey shows economy still expanding. The Beige Book survey indicated that energy weakness and a slow manufacturing sector didn’t hold the economy back too much between late February and early April.[12]

Quote Of The Week

“If you’re not willing to fail, you won’t succeed.” – Shai Agassi

Recipe Of The Week

Strawberry Pavlova

Strawberries highlight this light, airy dessert..

Serves 4

Ingredients:

- 3 large egg whites, at room temperature

- ¼ teaspoon cream of tartar

- ¾ cup plus 1 tablespoon white sugar

- 1 pound strawberries, rinsed, hulled, and quartered

- 1 teaspoon finely grated lemon zest

- Kosher salt

- 1 cup heavy cream

- ¼ cup crème fraiche or whole fat sour cream

Directions:

Preheat your oven to 225°F. Use a hand mixer to beat the egg whites until they are foamy. Add the cream of tartar and continue beating until the mixture forms soft peaks. Add ¾ cup of the sugar slowly while increasing the mixer’s speed. Continue to beat the meringue until the peaks are glossy and stiff.

Line a baking sheet with parchment paper and spread the meringue into a 10-inch circle in the middle of the parchment paper. Bake the meringue on the bottom rack of your oven for 2-½ to 3 hours until firm. Turn off the oven and allow the meringue to cool in the oven for several hours or overnight.

When cool, flip the meringue onto a serving plate and carefully peel the parchment paper off the top.

Just before you’re ready to serve the dessert, toss the quartered strawberries with lemon zest, a pinch of salt, and 1 tablespoon of sugar. Let them macerate for 20 minutes. In another bowl, whip the crème fraiche and heavy cream until the mixture forms soft peaks.

Top the meringue with the whipped cream and berries. Serve immediately.

Recipe adapted from RealSimple.com[13]

Tax Tips

Tips for Gift Taxes

If you gave someone money or property, you may owe taxes on the gift. Here are some tips to help you determine if your gift is taxable:

Non-taxable Gifts. While the default assumption is that gifts are taxable, the following are nontaxable gifts:

Gifts that do not exceed the annual exclusion for the calendar year ($14,000 in 2016)

Tuition or medical expenses you paid directly to a medical or educational institution for someone

Gifts to your spouse

Gifts to a political organization for qualified uses

Gifts to qualifying charities

Annual Exclusion. For 2016, the annual exclusion is $14,000. Gifts under that amount are not subject to the gift tax even if they don’t fall into one of the categories above. If you give a gift to someone else, the gift tax usually does not apply until the value of the gift exceeds the annual exclusion for the year.

Splitting a Gift. You and your spouse can jointly give a gift up to $28,000 to a third party without making it a taxable gift.

For more information on gifts and taxes, speak to a qualified tax professional.

Tip courtesy of IRS.gov[14]

Golf Tip

Fix Your Swing Rhythm

While many golfers have a solid, consistent short-game swing, they often lose that rhythm when it comes to a full golf swing. If you’re struggling with a choppy swing that feels too fast, try a simple drill.

Lay five golf balls in a vertical line just a few inches apart. Set up over the ball closest to you and start with a short chip swing. Then, increase the length of your swing with each ball. Focus on maintaining a steady rhythm in your swing. If you notice yourself speeding up with the fuller swings, make a note where it happens and repeat the drill until your full swing is as steady and consistent as your short chip.

Tip courtesy of Dan Martin, PGA | Golf Tips Mag[15]

Healthy Lifestyle

Skip the Fad Dieting. Eat Clean Instead.

Instead of trying the latest fad diet, experts recommend retraining your palate to appreciate fresh foods. Changing the overall way you eat can have longer-lasting effects on your health and weight than the drastic and unsustainable changes diets require. Follow these rules for eating clean:

Eat food closer to its natural state: Incorporate more raw, unsalted, and unprocessed foods in your diet.

Avoid the box: Stay away from processed foods that come in boxes.

Check the label: Read the labels of the foods you buy to seek out those with fewer ingredients and processing.

Snack smart: It’s hard for most people to avoid snacking on easy-to-prepare foods. Instead of cutting them out entirely and courting failure, prepare by keeping nuts, fruit, veggies, hummus, and other healthful snacks on hand.

Tip courtesy of AARP[16]

Green Living

Clean Water Deposits with Vinegar

If your coffee maker, iron, or washing machine is clogged with deposits, vinegar can help. Simply run through a cycle using a cup (or more) of white vinegar. You may need to repeat the process twice to get out all of the deposits.

Tip courtesy of Seattle PI[17]

Disclosures:

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Diversification does not guarantee profit nor is it guaranteed to protect assets.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. The DJIA was invented by Charles Dow back in 1896.

The Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of stocks of technology companies and growth companies.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indexes from Europe, Australia and Southeast Asia.

The S&P U.S. Investment Grade Corporate Bond Index contains U.S.- and foreign-issued investment-grade corporate bonds denominated in U.S. dollars.

The SPUSCIG launched on April 09, 2013. All information for an index prior to its Launch Date is back-tested, based on the methodology that was in effect on the Launch Date. Back-tested performance, which is hypothetical and not actual performance, is subject to inherent limitations because it reflects application of an Index methodology and selection of index constituents in hindsight. No theoretical approach can take into account all of the factors in the markets in general and the impact of decisions that might have been made during the actual operation of an index. Actual returns may differ from, and be lower than, back-tested returns.

The S&P/Case-Shiller Home Price Indices are the leading measures of U.S. residential real estate prices, tracking changes in the value of residential real estate. The index is made up of measures of real estate prices in 20 cities and weighted to produce the index.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

Featured Image Notes: All index returns exclude reinvested dividends, and the 5-year and 10-year returns are annualized. Sources: Yahoo! Finance, S&P Dow Jones Indices, and Treasury.gov. International performance is represented by the MSCI EAFE Index. Corporate bond performance is represented by the SPUSCIG. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

These are the views of Platinum Advisor Marketing Strategies, LLC, and not necessarily those of the named representative, Broker dealer or Investment Advisor, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer or Investment Advisor gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

Sources:

By clicking on these links, you will leave our server, as they are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

1 http://www.cnbc.com/2016/04/15/us-markets.html

2 http://finance.yahoo.com/q/hp?s=%5EGSPC&a=03&b=11&c=2016&d=03&e=15&f=2016&g=d

http://finance.yahoo.com/q/hp?a=03&b=11&c=2016&d=03&e=15&f=2016&g=d&s=%5EDJI%2C+&ql=1

http://finance.yahoo.com/q/hp?a=03&b=11&c=2016&d=03&e=15&f=2016&g=d&s=%5EIXIC%2C+&ql=1

3 http://www.zacks.com/commentary/78320/making-sense-of-bank-results

5 http://www.economist.com/blogs/graphicdetail/2016/04/daily-chart-11

6 http://www.bbc.com/news/business-36024492

7 http://www.cnbc.com/2016/04/16/draft-doha-agreement-would-freeze-oil-output-until-october.html

8 http://www.zacks.com/commentary/78320/making-sense-of-bank-results

9 http://www.foxbusiness.com/markets/2016/04/13/march-retail-sales-unexpectedly-fell-0-3.html

10 http://www.foxbusiness.com/markets/2016/04/14/weekly-jobless-claims-fall-by-13000.html

11 http://www.foxbusiness.com/markets/2016/04/15/consumer-sentiment-unexpectedly-slips-in-april.html

12 http://www.fox13memphis.com/news/fed-survey-finds-us-economy-expanding-at-modest-pace/215160421

13 http://www.realsimple.com/food-recipes/browse-all-recipes/strawberry-pavlova

14 https://www.irs.gov/uac/Tax-Tips-to-Help-You-Determine-if-Your-Gift-is-Taxable

15 http://www.golftipsmag.com/instruction/short-game/visualization/

16 http://www.aarp.org/health/healthy-living/info-2015/clean-eating-rules.html

17 http://www.seattlepi.com/news/article/52-tips-for-living-green-1269861.php