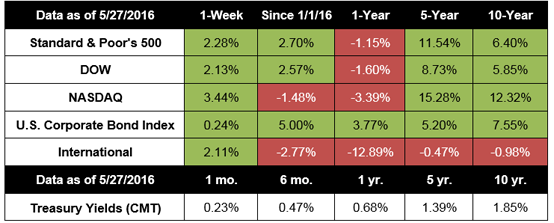

Stocks ended a solid week on a high note ahead of the Memorial Day weekend after statements by Federal Reserve officials boosted expectations of a rate hike this summer. For the week, the S&P 500 gained 2.28%, the Dow rose 2.13%, the NASDAQ increased 3.44%, and the MSCI EAFE added 2.11%.[1]

Markets jumped on Fed statements last week after the previous week’s release of minutes from the April Fed meeting fanned expectations of an interest rate hike soon. On Friday, Fed Chair Janet Yellen stated support for an interest rate hike over the next few months, indicating that yes, the Fed is looking hard at a June or July rate increase if data holds.[2] One measure of the probability of a rate hike at the June meeting rose to 34% after Yellen’s remarks, while bets on a July increase increased to 60%, more than double the probability estimate of a month ago.[3]

Does the data support the Fed’s view of healthy economic growth? So far, it might. We got our second look at first-quarter economic growth Friday, and the latest official estimate shows that the economy grew 0.8% in the first three months of the year.[4] Better-than-expected consumer spending led the increase, which is a good sign for the rest of the year. Fears about a recession seem to have largely faded as the latest data indicates more growth this year.

Two regional Fed banks raised their estimates of second-quarter growth last week as well, perhaps prepping markets for a rate increase soon. The New York Fed Nowcast Report increased its estimate of Q2 growth to 2.2% while the Atlanta Fed raised its GDPNow forecast to 2.9%.[5] Why the difference in two reports issued by the Federal Reserve?

To come up with their “nowcasts,” Fed economists use existing economic data, extrapolate other data that hasn’t been released yet, and use statistical models to come up with a real-time forecast for GDP growth far ahead of the official releases by the Bureau of Economic Analysis.

Forecasting is challenging because of the amount of noise associated with major macroeconomic indicators; even official estimates of past GDP growth are revised multiple times as data is released. The gap between the two Fed GDP forecasts is the result of different computational methods used to arrive at a growth estimate. Is either estimate 100% reliable? Most likely not, which is why we like to look at a variety of forecasts and indicators when building investment models. Regardless of which forecast you might prefer, both are trending in the same general direction.

This week, investors will key in on several important economic data releases, including the May jobs report on Friday. The health of the labor market is expected to take a major role in Fed deliberations on interest rates at the upcoming June Market Committee meeting.

ECONOMIC CALENDAR:

Tuesday: Personal Income and Outlays, S&P Case-Shiller HPI, Chicago PMI, Consumer Confidence, Dallas Fed Manufacturing Survey

Wednesday: Motor Vehicle Sales, ADP Employment Report, PMI Manufacturing Index, ISM Manufacturing Index, Construction Spending, Beige Book

Thursday: Jobless Claims, EIA Petroleum Status Report

Friday: Employment Situation, International Trade, Factory Orders, ISM Non-Manufacturing Index

HEADLINES:

- Weekly jobless claims fall. The number of Americans filing new claims for unemployment benefits fell by 10,000, bringing claims back in line with long-term trends. However, some seasonal factors may have affected the data.[6]

- Durable goods orders increase. New orders for long-lasting manufactured goods like electronics, appliances, and vehicles increased in April. However, much of the growth came from orders for commercial aircraft – a notoriously volatile category – and may not be sustainable.[7]

- Consumer sentiment rises in May. A measure of American optimism about the economy increased to the highest levels in nearly a year as cheap gasoline, low interest rates, and an improving economic picture boosted sentiment.[8]

- Pending home sales increase to 10-year high. The number of homes under contract rose 5.1% over March levels, indicating the housing market is gaining steam.[9]

Quote Of The Week

“I think that the good and the great are only separated by the willingness to sacrifice.” – Kareem Abdul-Jabbar

Recipe Of The Week

Dressed Up Store Pizza

Serves 4

Ingredients:

1 store-bought refrigerated or frozen pizza

1 cup shredded Romano cheese or Aged Italian Cheese mix

1 12-ounce jar artichoke hearts, drained

4 ounces of black or green olives, sliced

1 8-ounce container of cherry or grape tomatoes, sliced in half

1 bunch fresh basil or oregano leaves

1 ounce extra virgin olive oil

Chef’s Tip: The key to making a plain store-bought pizza stand out is to add your favorite combinations. If you like Hawaiian pizzas, stop by the deli counter for ham and pick up a can of sliced pineapple. Love goat cheese? Get a white pizza and add fresh goat cheese, figs, and a drizzle of balsamic vinegar.

Directions:

Follow the cooking instructions on the pizza. Before sliding it in the oven, add the artichoke hearts, olives, and tomatoes.

Halfway through cooking, add the shredded cheese so that it doesn’t overcook.

Before serving, add the fresh herbs and drizzle the olive oil on top.

Recipe adapted from J. Kenji López-Alt | Serious Eats[10]

Tax Tips

Do You Need to Pay Estimated Taxes?

While most employees have taxes automatically withheld from their pay, if you are self-employed or don’t have enough taxes withheld from your paycheck, you may need to make estimated tax payments throughout the year. Here’s what you need to know:

You should make estimated tax payments if you expect to owe at least $1,000 in taxes in 2016 after subtracting your withholding and refundable credits.

To calculate the tax, estimate the amount of income you expect to receive for the year, taking into account any tax deductions and credits you can claim. Use Form 1040-ES to figure your tax.

Most people should make estimated tax payments four times a year. In 2016, those dates are April 18, June 15, September 15, and January 17, 2017.

You can make estimated payments by mail, over the phone, and online.

For more information about paying estimated taxes or adjusting your withholding, speak to a qualified tax specialist or visit IRS.gov.

Tip courtesy of IRS.gov[11]

Golf Tip

Use Your Buttons

To hit better wedges and chips, you need to use a whole-body pivot instead of just your arms and hands. Instead of relying on your hands in the shot, turn your upper body so that your shirt buttons are turned beyond the target at finish. Ideally, you want your whole body to turn and use the energy of your body’s rotation to power the shot.

Tip courtesy of Jack Crosley, PGA | Golf Tips Mag[12]

Healthy Lifestyle

Slow Walking May Signal Alzheimer’s

Scientists looking for early signs of dementia or Alzheimer’s found that a slower walking pace correlated with higher levels of amyloid plaques in the brain. A buildup of this kind of plaque is strongly associated with Alzheimer’s disease. Though researchers pointed out that dementia may not directly cause slow walking, a reduction in gait may be a good warning sign for the need for medical testing.

Tip courtesy of AARP[13]

Green Living

Got a Mosquito Problem? Keep Them Away Naturally.

As the weather warms, mosquitos can become an ever-present annoyance to your outdoor gatherings. To keep the critters away from you, try the following remedies:

Instead of using a chemical bug spray like DEET, try lighting citronella candles or rubbing soybean oil on your skin.

Prevent mosquitos from reproducing in standing pools of water by pouring the water out or adding a small amount of vinegar or bleach to the water. If you have bird baths or a rain barrel, ask your local aquarium store about mosquitofish.

Mosquitos don’t like breezes, so situate yourself in an area with moving air or bring a fan outside.

Attract mosquito-eating bats with bat houses, available online or at your local hardware store.

Tip courtesy of AARP[14]

Disclosures

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Diversification does not guarantee profit nor is it guaranteed to protect assets.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. The DJIA was invented by Charles Dow back in 1896.

The Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of stocks of technology companies and growth companies.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indexes from Europe, Australia and Southeast Asia.

The S&P U.S. Investment Grade Corporate Bond Index contains U.S.- and foreign-issued investment-grade corporate bonds denominated in U.S. dollars.

The SPUSCIG launched on April 09, 2013. All information for an index prior to its Launch Date is back-tested, based on the methodology that was in effect on the Launch Date. Back-tested performance, which is hypothetical and not actual performance, is subject to inherent limitations because it reflects application of an Index methodology and selection of index constituents in hindsight. No theoretical approach can take into account all of the factors in the markets in general and the impact of decisions that might have been made during the actual operation of an index. Actual returns may differ from, and be lower than, back-tested returns.

The S&P/Case-Shiller Home Price Indices are the leading measures of U.S. residential real estate prices, tracking changes in the value of residential real estate. The index is made up of measures of real estate prices in 20 cities and weighted to produce the index.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

Featured Image Notes: All index returns exclude reinvested dividends, and the 5-year and 10-year returns are annualized. Sources: Yahoo! Finance, S&P Dow Jones Indices, and Treasury.gov. International performance is represented by the MSCI EAFE Index. Corporate bond performance is represented by the SPUSCIG. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

These are the views of Platinum Advisor Marketing Strategies, LLC, and not necessarily those of the named representative, Broker dealer or Investment Advisor, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer or Investment Advisor gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

Resources

By clicking on these links, you will leave our server, as they are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

1 http://finance.yahoo.com/q/hp?s=%5EGSPC&a=04&b=23&c=2016&d=04&e=27&f=2016&g=d

http://finance.yahoo.com/q/hp?a=04&b=23&c=2016&d=04&e=27&f=2016&g=d&s=%5EDJI%2C+&ql=1

http://finance.yahoo.com/q/hp?a=04&b=23&c=2016&d=04&e=27&f=2016&g=d&s=%5EIXIC%2C+&ql=1

https://www.msci.com/end-of-day-data-search

2 http://www.reuters.com/article/us-usa-fed-yellen-idUSKCN0YI1TX

3 http://www.reuters.com/article/us-usa-fed-yellen-idUSKCN0YI1TX

4 http://www.bea.gov/newsreleases/national/gdp/gdpnewsrelease.htm

5 https://www.newyorkfed.org/medialibrary/media/research/policy/nowcast/nowcast_2016_0527.pdf?la=en

https://www.frbatlanta.org/-/media/Documents/cqer/researchcq/gdpnow/RealGDPTrackingSlides.pdf

6 http://www.foxbusiness.com/markets/2016/05/26/weekly-jobless-claims-fall-by-10000.html

7 http://www.foxnews.com/us/2016/05/26/us-durable-goods-orders-up-but-business-investment-slips.html

8 http://www.foxbusiness.com/markets/2016/05/27/consumer-sentiment-rises-in-may.html

9 http://www.foxbusiness.com/markets/2016/05/26/pending-home-sales-climbed-to-highest-level-in-10-years.html

10 http://slice.seriouseats.com/archives/2013/02/how-to-dress-up-your-frozen-pizza.html

11 https://www.irs.gov/uac/five-tax-tips-on-estimated-tax-payments

12 http://www.golftipsmag.com/instruction/short-game/out-turn-your-target/

13 http://blog.aarp.org/2015/12/03/slow-walking-may-be-a-sign-of-early-alzheimers/

14 http://www.aarp.org/health/healthy-living/info-2015/summer-survival-guide.html