WEEKLY UPDATE – FEBRUARY 3, 2020

The Week on Wall Street

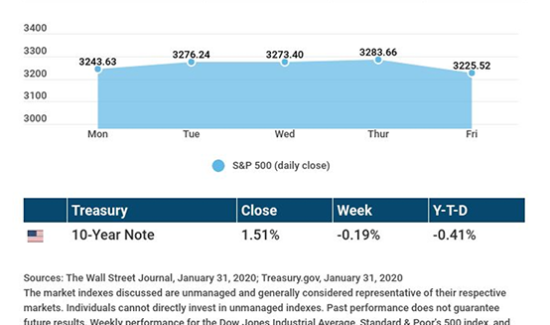

Stock benchmarks declined for a second straight week as coronavirus news tempered risk appetite.

The S&P 500 fell 2.14% on the week. The Nasdaq Composite dipped 1.76%, and the Dow Jones Industrial Average, 2.55%. Away from North America, developed markets slumped 2.24%, according to MSCI’s EAFE index.[1][2]

The Fed Makes a Minor Move

The Federal Reserve left short-term interest rates alone at its January meeting, but it did make what Fed chairman Jerome Powell called a “small technical adjustment” in view of its continuing purchases of Treasuries. Wednesday, it slightly increased the interest rate paid to banks that park excess capital reserves at the Fed.

The move may give the Fed a bit more control over short-term rates this quarter and assist the operations of U.S. financial markets.[3]

Encouraging New Consumer Data

Rising to 131.6 in January, the Conference Board’s Consumer Confidence Index reached its highest level since August. Consumer spending increased 0.3% in December, according to a new Department of Commerce report.[4][5]

Economy Expanded at a 2.1% Pace in Fourth Quarter

The Bureau of Economic Analysis released this estimate Thursday. That number matches the gross domestic product of the third quarter and affirms that the U.S. avoided a fall slowdown.[6]

THE WEEK AHEAD: KEY ECONOMIC DATA

Monday: The latest snapshot of factory sector health from the Institute for Supply Management, presenting January data.

Wednesday: ISM’s January report on the state of non-manufacturing businesses and the latest private-sector payrolls report from Automatic Data Processing (ADP).

Friday: The Department of Labor releases its January employment report.

Source: MarketWatch, January 31, 2020

The MarketWatch economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Monday: Alphabet (GOOG), Sysco (SYY)

Tuesday: BP (BP), Fiserv (FISV), Gilead Sciences (GIL), Walt Disney (DIS)

Wednesday: GlaxoSmithKline (GSK), Merck (MRK), Qualcomm (QCOM), Toyota (TM)

Thursday: Bristol-Myers Squibb (BMY), Cigna (CI), Philip Morris (PM), Sanofi (SNY)

Friday: AbbVie (ABBV), Honda (HMC), Novo Nordisk (NVO)

Source: Zacks, January 31, 2020

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

Quote Of The Week

“It took me quite a long time to develop a voice, and now that I have it, I am not going to be silent.” – Madeleine Albright

Recipe Of The Week

Good Ol’ Chicken Soup

Serves 10

Ingredients:

1 whole chicken, about 3 lbs.

4 carrots, halved

4 stalks celery, halved

½ potato, diced

1 cup of green peas

1 large onion, halved

Water to cover

Salt and pepper, to taste

1 tsp. chicken bouillon granules (optional)

Directions:

Place chicken and vegetables (except potato and peas) in a large pot.

Cover contents with cold water

Heat and simmer, uncovered, skimming foam now and then.

Once cooked to point where chicken easily falls off bone.

Strain the broth, remove all other contents, and set aside.

Season broth with bouillon, salt, and pepper.

Add potatoes and peas to broth.

Pick chicken meat from bones and return meat to broth.

Chop vegetables and return to broth.

Once potatoes and peas are fully cooked, serve.

Recipe adapted from allrecipes.com[7]

Tax Tips

Do You Know the Difference Between Taxable and Nontaxable Income?

All income you receive is taxable unless the rules explicitly state that it isn’t. According to the IRS, taxable income includes earned income, like wages, as well as any income earned by bartering or the exchange of property or services. Rental income is taxable, as are other forms of unearned income, like interest and dividends or Social Security.

Some income is not taxable unless certain conditions are met. For example, life insurance proceeds are usually not taxable to the beneficiary unless you redeem a life insurance policy for cash. Any amount you receive above the cost of the policy is taxable. State and local income tax refunds may be taxable and should be reported on your federal taxes.

There are also some forms of income that are usually not taxable:

Gifts and inheritances.

Child support payments.

Welfare benefits.

Damage awards for physical injury or sickness.

Cash rebates from a dealer or manufacturer for an item you buy.

Reimbursements for qualified adoption expenses.

- This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS.gov[8]

Golf Tip

A Two-Piece Ball or a Multi-Layer Ball?

Besides the construction, what differentiates a two-piece golf ball from a multi-layer golf ball? Do the two different types of cores suit different types of golfers?

In a general sense, yes. Different golfers have different swing speeds, and multi-layer golf balls are a response to this reality. A two-piece ball just has a skin and a large core, so it can easily absorb power transferred from a slower swing. A golfer who consistently shoots in the seventies or eighties probably has a faster swing and can likely shape a shot better than a high handicapper. A hard, fast swing (think 280-yard drive) will activate all the layers in a multi-layer ball; a less forceful swing (think 40-yard soft pitch) will just activate outer layers, allowing a really good golfer more control, backspin, and feel on such a shot. If you consistently break 90, you should play a multi-layer ball.

Tip adapted from TGW.com[9]

Healthy Lifestyle

Show Your Heart Some Love

This February is American Heart Month. Heart disease is the number one killer of men and women in the U.S., accounting for 25% of all deaths. While genetics and family history are primary risk factors, some lifestyle habits are associated with better heart health. But first, make sure to discuss any medical concerns with your health care provider before beginning any dietary and fitness regimen; this information is not a substitute for medical advice.

Manage your blood pressure. And get it checked regularly. Hypertension is often asymptomatic.

Maintain a healthy weight. Being overweight or obese may increase disease risk.

Eat well and exercise. Both are associated with lower incidence of heart disease.

Drink less alcohol and don’t smoke. These habits are harmful to your cardiovascular health.

Sleep well and reduce stress. Lower cortisol levels may reduce your risk.

While not all disease risk factors are controllable, some are. The list above, however, is not comprehensive. Give your heart some love this month and talk to your doctor about the best ways to care for it.

Tip adapted from MedlinePlus.gov[10]

Green Living

Swap Paper Towels with Cloth

Many items in your kitchen have environmentally friendly replacements that can make a big difference over time.

One of the biggest things you can do is to replace your paper towels with cloth ones. You’ll have to wash them more, but you’ll be able to reuse them over and over again. Because the fabric and clothing industry isn’t known for being especially eco-conscious, pick up several sets of cloth napkins at a thrift store. Not only will you score a great bargain, but you won’t feel bad about staining the napkins you typically use for special occasions.

Tip adapted from Green Living Ideas[11]

Share the Wealth of Knowledge!

Please share this market update with family, friends, or colleagues. If you would like us to add them to our list, simply click the sharing buttons below. We love being introduced!

Disclosures

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Diversification does not guarantee profit nor is it guaranteed to protect assets.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. The DJIA was invented by Charles Dow back in 1896.

The Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of stocks of technology companies and growth companies.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indices from Europe, Australia, and Southeast Asia.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

These are the views of Platinum Advisor Strategies, LLC, and not necessarily those of the named representative,

Broker dealer or Investment Advisor and should not be construed as investment advice. Neither the named representative nor the named Broker dealer or Investment Advisor gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

Resources

By clicking on these links, you will leave our server, as the links are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

[1] www.wsj.com/market-data

[2] quotes.wsj.com/index/XX/MSCI%20GLOBAL/990300/historical-prices

[3] www.marketwatch.com/story/fed-holds-benchmark-interest-rate-steady-sees-economy-growing-at-moderate-pace-2020-01-29

[4] www.investing.com/economic-calendar/cb-consumer-confidence-48

[5] www.investing.com/economic-calendar/personal-spending-235

[6] www.marketwatch.com/story/economy-grows-21-in-the-4th-quarter-as-gdp-gets-big-boost-from-falling-trade-deficit-2020-01-30

[7] www.allrecipes.com/recipe/8814/homemade-chicken-soup/

[8] www.irs.gov/businesses/small-businesses-self-employed/what-is-taxable-and-nontaxable-income

[9] www.tgw.com/golf-guide/golf-ball-shopping-tips/

[10] medlineplus.gov/howtopreventheartdisease.html

[11] greenlivingideas.com/2019/08/22/zero-waste-kitchen-6-single-use-items-to-replace/