No one wants to see a clash between two nations with nuclear capabilities. So, when the war-of-words between North Korea and the U.S. reached a new level earlier this month, markets briefly stumbled as investors grew uneasy. While we don’t normally opine on geopolitical events, we wanted to help ease any financial worries you may have related to this recent conflict.

When sharing this analysis, we certainly do not have a crystal ball – and we recognize that any military escalation could affect far more than your investments. But, as we all look to see what’s on the horizon, we believe that historic perspective may help assuage concerns about the tension’s impact on your financial future.

What can we learn from the past?

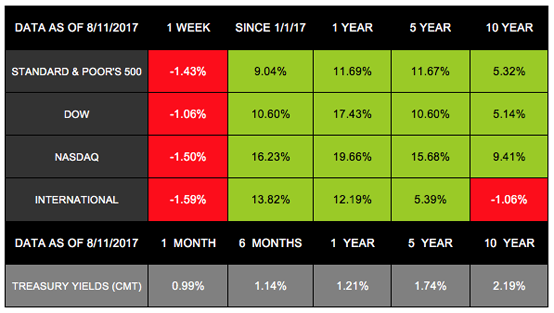

Data from Strategas Research Partners shows us that while the markets often have negative reactions to events when they first occur – they can recover within days or months.[1]

For instance, on the day of Pearl Harbor, the S&P 500 declined 3.8%, but it was back within positive territory 20 days later. And just last year, the S&P 500 dropped 3.6% when the BREXIT vote came through – then was up by 19.5% a few months later.[2]

History also shows us that war often does little to bring down the financial markets. In the month that two atomic bombs fell on Japan, the S&P 500 gained 5.8%.[3]

Of course, no one wants to imagine the tension with North Korea escalating into war. Thankfully, Pyongyang announced on August 15 that they would not, in fact, strike near Guam. And with U.S. Secretary of State Rex Tillerson’s assertion that there is no “imminent threat” of nuclear attack, the risk of war seems to be retreating.[4]

What should you do now?

Looking forward, we must remember that the markets don’t always bounce back quickly after geopolitical events – but making fear-based choices can be very costly in the long run. No matter what happens, we are here to help you stay abreast of current market dynamics and focus on the economic fundamentals that drive lasting value.

We will continue to monitor the situation in North Korea, but headlines won’t distract us from pursuing our true goal: moving you toward the future you desire. If you want to discuss your specific strategy or investments in greater detail, please contact us any time.

And if you’d like to gain a wider understanding of how the markets have responded to geopolitical events in the past, explore the chart from CNBC and Strategas Research Partners included below at the end of this message.

“Geopolitics can create anxiety in financial markets, but aren’t going to bring the $18.5 trillion beast, otherwise known as the U.S. economy, to its knees.”

– David Rosenberg, chief economist and strategist at Gluskin Sheff[5]

Source: CNBC, Strategas Research Partners[6]

Warmest regards,

Rob

Share the Wealth of Knowledge!

Please share this market update with family, friends, or colleagues. We love being introduced!

Disclosures

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

S&P 500 Index is an unmanaged group of securities considered to be representative of the stock market in general. You cannot directly invest in the index.

Past performance does not guarantee future results.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors. Notes: All index returns (except S&P 500) exclude reinvested dividends, and the 5- year and 10-year returns are annualized. The total returns for the S&P 500 assume reinvestment of dividends on the last day of the month. This may account for differences between the index returns published on Morningstar.com and the index returns published elsewhere. International performance is represented by the MSCI EAFE Index. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

These are the views of Platinum Advisor Marketing Strategies, LLC, and not necessarily those of the named representative, Broker dealer or Investment Advisor, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer or Investment Advisor gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

Resources

By clicking on these links, you will leave our server, as they are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

[1] https://www.cnbc.com/2017/08/09/as-north-korean-tensions-simmer-heres-how-stocks-reacted-to-past-crises.html?__source=newsletter|eveningbrief

[2] https://www.cnbc.com/2017/08/09/as-north-korean-tensions-simmer-heres-how-stocks-reacted-to-past-crises.html?__source=newsletter|eveningbrief

[3] https://www.usatoday.com/story/money/2017/08/10/main-street-investors-can-cope-n-korea/554033001/

[4] http://time.com/4892949/rex-tillerson-donald-trump-north-korea-threat/

[5] http://www.cpreports.com/2017/08/14/market-alert-wall-street-rumblings-issue-444-august-13-2017-by-ray-dirks/

[6] https://www.cnbc.com/2017/08/09/as-north-korean-tensions-simmer-heres-how-stocks-reacted-to-past-crises.html?__source=newsletter|eveningbrief