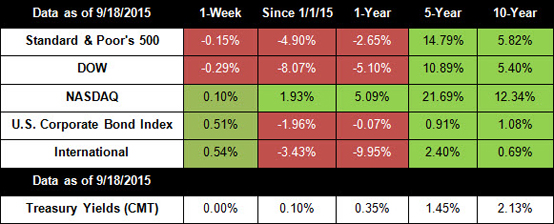

Uncertainty about the Federal Reserve’s decision on interest rates weighed on markets last week, pushing the Dow and the S&P lower. For the week, the S&P 500 lost 0.15%, the Dow fell 0.29%, while the NASDAQ gained 0.10%.[1]

On Thursday, the Federal Reserve voted to hold interest rates steady at near zero for at least another month. Did the Fed choke or are officials just being cautious? It’s hard to say, but we now know that recent global economic events are an official problem for the U.S. Though the Fed economists believe the labor market and other sectors of the U.S. economy are doing well, they cited three factors in their decision to keep rates low:[2]

Weakening inflation pressure because of falling oil and gasoline prices, as well as a stronger dollar.

Recent global events like China’s surprise Yuan devaluation and recent economic reports that raise concerns about slowing worldwide.

Financial developments like the recent stock market correction.

Investors read the decision as a vote of no confidence in the economy on the part of the Fed and reacted with another selloff. However, much like the run-up to Y2K or the panic surrounding the tapering of quantitative easing, we think that a lot of the recent headlines are simply hyperbole.

The Fed doesn’t feel a lot of pressure to raise interest rates because inflation is still quite tame, and the risk of an overheated economy is low. Right now, the Fed’s main concern is risk management; central bankers don’t want to risk tightening too soon in an environment of slowing global growth. Instead, they’d rather commit to a slow, gradual approach that gives them plenty of wiggle room to adjust to changing conditions.

Relax. A rate hike is coming. Some think it will happen in December while others think the Fed will hold off until early 2016. What’s important is that our domestic economy is looking solid, and the Fed doesn’t want to act hastily. Realistically, we can expect market volatility to continue for the near future as investors price in the uncertainty.

The week ahead will be highlighted by a speech by Fed chair Janet Yellen as well as another report on second-quarter GDP. Analysts will be looking for more clarity about the Fed’s path to higher interest rates. Chinese President Xi Jinping will also be visiting the U.S. and analysts hope that he’ll provide some insight into how China plans to tackle their growth problem.[3]

ECONOMIC CALENDAR:

Monday: Existing Home Sales

Wednesday: PMI Manufacturing Index Flash, EIA Petroleum Status Report

Thursday: Durable Goods Orders, Jobless Claims, New Home Sales, Janet Yellen Speaks 5:00 PM ET

Friday: GDP, Consumer Sentiment

HEADLINES:

- Greek exit polls show left-wing win. Projections suggest that the left-wing Syriza party responsible for the debt showdown likely won Sunday’s elections. The win could mean that further austerity fights are in store for Greece’s creditors.[4]

- Housing starts fall more than expected. Groundbreaking on new houses dropped more than projected in August, though permits for new construction rebounded, pointing to underlying strength in the housing market.[5]

- Weekly jobless claims fall to multi-month low. The number of Americans filing new claims for unemployment benefits fell to the lowest level since mid-July, suggesting that the labor market continues to improve, though the data may be volatile due to the Labor Day holiday.[6]

- Consumer prices fall. Prices on a range of U.S. goods and services fell last month as gasoline prices dropped again and the U.S. dollar gained strength. Falling inflation complicates the Fed’s decision on interest rate raises.[7]

Quote of the Week

“A friendship founded on business is a good deal better than a business founded on friendship.” – John D. Rockefeller

Tax Tip of the Week: Protect Your Records from Disaster

Natural disasters can strike at any time, and it’s important to take steps to protect your tax and financial records. Here are some tips from the IRS:

Keep electronic backups. Many people get emailed financial statements, which are a good way to ensure you always have access to these important documents. Ask your advisor for help scanning tax records, insurance policies, estate papers, and any other paper documents. Be sure to back up any CDs, DVDs, or external hard drives somewhere outside your house.

Document your valuables. Take photos or a video of the contents of your home, office, or vacation house. This record will help document any losses for insurance claims or for deductions on your tax return.

Know where to get copies of tax returns and transcripts. Ask your tax advisor for help filing a request for lost tax returns or a free transcript.

For more information about disaster assistance, speak to your advisor or call the IRS disaster hotline at 866-562-5227.

Tip courtesy of IRS.gov [9]

Click here to view full newsletter including reference articles, golf tips, our recipe of the week and more!

Notes on featured image: All index returns exclude reinvested dividends, and the 5-year and 10-year returns are annualized. Sources: Yahoo! Finance and Treasury.gov. International performance is represented by the MSCI EAFE Index. Corporate bond performance is represented by the DJCBP. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly