The Week on Wall Street

Despite news of another COVID-19 vaccine candidate, stocks were mixed amid investor anxiety over an increase in new infections and economic lockdowns.

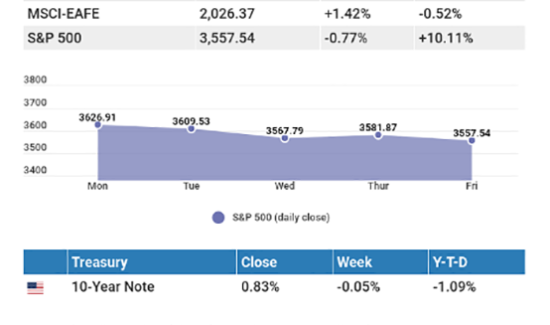

The Dow Jones Industrial Average fell 0.73%, while the Standard & Poor’s 500 declined 0.77%. The Nasdaq Composite index rose 0.22% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, gained 1.42%.[1][2][3]

Groundhog Week

The announcement of another potential COVID-19 vaccine ignited strong gains to begin the week. But, like the week that preceded it, the gains sparked by the vaccine news were eroded in the following days as worries over the economic impact of new infections moved to the fore.

The market has been grappling with conflicting narratives. One is the optimistic view that, with COVID-19 vaccines apparently near at-hand, the return to economic normalcy grows ever closer. That hopeful outlook has been offset by anxiety over new infections, rising hospitalizations, and some local and state lockdowns.

These crosscurrents kept stocks range bound for the week, with the technology sector and small and mid-size stocks lending support to the overall market.

Powell Sounds a Warning

In a speech last week, Federal Reserve Chairman Jerome Powell warned that the nationwide increase in COVID-19 cases could hamper economic activity in the upcoming months. He expressed concern that consumer spending may trend lower despite efforts to control the spread of infections.[4]

Powell once again voiced his support for additional fiscal stimulus to assist small businesses, state and local governments, and the unemployed. He also said that even after full economic recovery, some businesses and workers may wrestle with an economic landscape altered by the coronavirus.

THIS WEEK: KEY ECONOMIC DATA

Tuesday: Consumer Confidence.

Wednesday: Durable Goods Orders, Gross Domestic Product (GDP), Jobless Claims, Consumer Sentiment, New Home Sales.

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THIS WEEK: COMPANIES REPORTING EARNINGS

Tuesday: Best Buy (BBY), Medtronic (MDT), Dollar Tree (DLTR), Dell Technologies (DELL), VMware (VMW), Analog Devices (ADI)

Friday: Deere & Company (DE)

Source: Zacks, November 20, 2020

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

Quote Of The Week

Vegetables are a must on a diet. I suggest carrot cake, zucchini bread, and pumpkin pie.”

– Jim Davis

Recipe Of The Week

Sweet Potato Casserole

6-8 servings

Ingredients:

For the Filling

- ½ stick of unsalted butter, melted

- 3-4 large sweet potatoes, peeled and cubed

- ½ cup milk

- ¼ cup brown sugar

- 1 teaspoon vanilla extract

- ½ teaspoon salt

- 2 eggs

For the Topping

- ½ cup flour

- ½ cup brown sugar

- ½ stick unsalted butter, melted

- ¼ teaspoon salt

- ¾ cup chopped pecans

Directions:

- Boil the sweet potatoes for about 15-20 minutes or until very tender. Drain, let cool, and mash.

- Preheat the oven to 350 degrees. Butter a 2-quart baking dish.

- Whisk together the butter, sweet potatoes, milk, brown sugar, vanilla, salt, and eggs and transfer to the baking dish.

- For the topping, combine all the topping ingredients in a medium bowl until the mixture is moist and clumps together. Spread the topping over the sweet potatoes in an even layer.

- Bake for about 25-30 minutes.

Recipe adapted from Food Network[5]

Tax Tips

Tips to Protect Yourself From Identity Theft

Tax-related identity theft is when someone uses your personal information to file a fraudulent tax return. They can use information like your Social Security number and other personal details.

Here are some tips to protect yourself:

- Always use security software on your computer, including anti-virus protection.

- Use a strong and unique password for each of your online accounts.

- Look out for spam calls, emails, and texts and report them to the IRS.

- Protect your information and any of your dependents’ info, as well.

Today’s identity criminals are getting more creative, but you can protect yourself by taking these important steps. Always be careful of who you give your information to.

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS[6]

Golf Tip

How to Get Out of an Uphill Bunker Shot

Landing in the bunker is hard enough, but landing in the bunker and navigating an uphill lie is a tricky shot for even the most seasoned golfers. There are a few tricks to follow, though, that can help with this shot.

First, make sure you angle your shoulders to match the slope, rather than trying to go in with your normal set up. If you do this, you’ll be more likely to get your club stuck in the sand. Instead, put a little weight on your front foot and then lean back into the slope.

The second tip is to make sure you choose the right club. You need less club, like a sand wedge, to help the ball roll more.

Tip adapted from PGA Tour[7]

Healthy Lifestyle

Wake Up With This Morning Breathing Exercise

We’re back at it with one last breathing exercise for stress management! This one is perfect to do first thing in the morning to help relieve muscle stiffness and clear your breathing passages.

From a standing position, bend forward at the waist, slightly bend your knees, and let your arms hang loosely toward the floor. As you inhale slowly and deeply, slowly roll up to a standing position, lifting your head last. Hold your breath for a few seconds in this standing position, then exhale slowly as you bend back down from the waist. Repeat as needed.

Tip adapted from University of Michigan Medical School[8]

Green Living

Eco-Friendly Thanksgiving Tips

These tips will help you enjoy your Thanksgiving festivities while also being eco-friendly:

- Use the good cloth napkins and dishes instead of disposable plastic ones.

- Decorate with nature instead of plastic or synthetic decorations. Fall leaves, acorns, pinecones, and flowers make beautiful fall decorations.

- Reduce your energy usage by cooking things at the same time to limit how much you have to use your appliances.

- Prepare less food to reduce food waste. Or, properly store and freeze leftovers so you can enjoy them later!

- Buy local and organic produce. Local and organic produce requires less energy to produce and transport.

Tip adapted from EcoWatch[9]

Share the Wealth of Knowledge!

Please share this market update with family, friends, or colleagues. If you would like us to add them to our list, simply use one of the sharing buttons below. We love being introduced!

Disclosures

<small>Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Diversification does not guarantee profit nor is it guaranteed to protect assets.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. The DJIA was invented by Charles Dow back in 1896.

The Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of stocks of technology companies and growth companies.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indices from Europe, Australia, and Southeast Asia.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

These are the views of Platinum Advisor Strategies, LLC, and not necessarily those of the named representative,

Broker dealer or Investment Advisor and should not be construed as investment advice. Neither the named representative nor the named Broker dealer or Investment Advisor gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial professional for further information.Resources

By clicking on these links, you will leave our server, as the links are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

The market indexes discussed are unmanaged and generally considered representative of their respective markets. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.[1] The Wall Street Journal, January 8, 2021

<br />

[2] The Wall Street Journal, January 8, 2021

<br />

[3] The Wall Street Journal, January 8, 2021

<br />

[4] The Wall Street Journal, January 6, 2021

<br />

[5] CNBC, January 8, 2021

<br />

[6] The Wall Street Journal, January 8, 2021

<br />

[7] The Wall Street Journal, January 8, 2021

<br />

[8] KitchenConfidante.com, January 8, 2021

<br />

[9] IRS.gov, January 8, 2021

<br />

[10] YourTahoePlace.com, January 8, 2021

<br />

[11] CDC.gov, September 25, 2020

<br />

[12] TheSpruce.com, October 12, 2019</small>