The Week on Wall Street

As November wrapped up, U.S. equity benchmarks advanced. Stocks were again aided by a sense of optimism that a preliminary U.S.-China trade deal could be near.

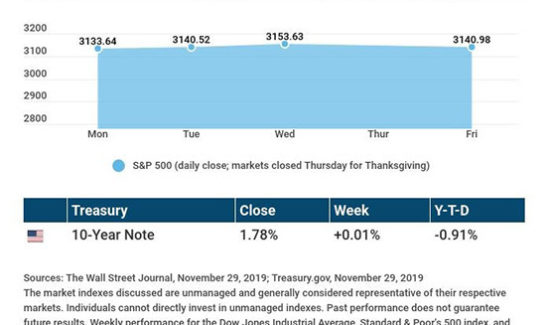

For the week, the Nasdaq Composite added 1.87%; the S&P 500, 1.21%; the Dow Jones Industrial Average, 1.03%. The MSCI EAFE index, which measures the performance of developed stock markets outside North America, gained 0.89%.[1][2]

Markets Wait for News of a Trade Pact

Wednesday, a senior White House official told Politico that the U.S. was “millimeters away” from a phase-one trade agreement with China, a deal that might involve the removal of certain tariffs.

Still, friction remains within the Sino-American relationship. Last week, President Trump signed two bills into law backing pro-democracy demonstrators in Hong Kong. China’s Ministry of Foreign Affairs quickly reacted, stating that American lawmakers had “sinister intentions” and adding that China would take “strong counter-measures” in return.[3][4]

The Latest on Consumer Spending and Consumer Confidence

Personal spending was up 0.3% in October, according to the Department of Commerce. This happened even with no gain in household incomes.

The Conference Board said its Consumer Confidence Index came in at 125.5 for November. Even though it has declined for four straight months, the index remains well above levels seen during the first half of the decade.[5][6]

THE WEEK AHEAD: KEY ECONOMIC DATA

Monday: The Institute for Supply Management provides its latest monthly index of U.S. manufacturing activity (November).

Wednesday: The ISM presents its November Non-Manufacturing Index, and Automatic Data Processing (ADP) publishes its November payrolls report.

Friday: November hiring data arrives from the Department of Labor, and the University of Michigan’s preliminary December Consumer Sentiment Index appears.

Source: Econoday, November 29, 2019

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Tuesday: Salesforce (CRM), Workday (WDAY)

Wednesday: RBC (RY)

Thursday: Dollar General (DG), TD Bank (TD)

Source: Zacks, November 29, 2019

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

Quote of the Week

“December. A month of lights, snow and feasts; time to make amends and tie loose ends; finish off what you started and hope your wishes come true” -Unknown

Recipe Of The Week

Super-Gooey Cinnamon Rolls

There’s no time like the holidays to enjoy something warm, gooey, and totally indulgent. Enter: cinnamon rolls! Make these cinnamon rolls to impress guests, bring to your next holiday party, or just devour at home.

[10 servings]

Ingredients

For the Dough:

1¼ cups milk, warmed

½ cup sugar

1 Tbsp. active-dry yeast

½ tsp. salt

½ cup butter, softened

2 eggs

4½ cups bread flour

For the Filling:

½ cup of butter, softened

1 cup sugar

1 Tbsp. cinnamon

For the Glaze:

½ cup browned butter

3 Tbsp. whole milk

2 tsp. vanilla extract

1 tsp. cinnamon

3½ cups confectioner’s sugar

Directions

Pour the milk and half of the sugar (¼ cup) into a mixing bowl and stir together.

Sprinkle in the yeast and allow the mixture to sit until the yeast starts to bubble and foam, about 5 minutes.

Stir in the remaining sugar (¼ cup), salt, butter, and eggs. Mix until combined and begin adding the flour slowly to incorporate.

Once the flour is mixed in, knead it on a clean, lightly floured surface. Knead until smooth, about 7 minutes.

Place the dough in a lightly greased bowl, cover it with a clean, damp towel, and let it rest until the dough has doubled in size, about an hour.

While the dough is resting, simmer both the butter for the glaze and butter for the filling (1 cup total) in a medium saucepan until brown, about 15 to 20 minutes.

Divide the butter into two separate bowls and let them cool for about 20 minutes.

In another bowl, mix together the sugar and cinnamon for the filling (1 cup sugar, plus 1 tsp. cinnamon).

Once the dough has doubled in size, punch down the center and turn it onto a clean, lightly floured surface. Roll out the dough until it’s about ¼-inch thick.

Brush the dough with browned butter from one of the bowls. Dust with the cinnamon-sugar mixture.

Roll the rectangle of dough until it’s in the form of a log, and pinch the seam shut. With the seam side down, cut into 10 cinnamon rolls.

Place the cinnamon rolls into a lightly greased baking dish and cover with a clean, damp towel. Let it rest until the rolls double in size, about an hour.

Preheat the oven to 350° F and bake them for 25 to 30 minutes.

For the glaze, stir the milk, vanilla, cinnamon, confectioner’s sugar, and remaining browned butter until combined. Slowly stir in the sugar.

Pour half the glaze over the cinnamon rolls as they cool for another 30 minutes, and save half for when they’re ready to serve.

Recipe adapted from Spoon Fork Bacon[7]

Tax Tips

Stay Safe While Shopping Online

It’s the most wonderful time of the year for online shopping! Buy your holiday gifts with ease with these tips on how to protect your data online:

Don’t enter your credit card information if you’re connected to an unsecure Wi-Fi network.

Only shop at sites that you know and make sure they have an “https://:” URL (the “s” in the URL means that it’s secure).

Recognize phishing emails, never click on links you don’t know, and report scams that ask for financial information to the IRS.

Keep your computer and security software up to date.

Use strong, long, and unique passwords. Use a combination of letters, numbers, and special characters.

Use multifactor authentication when available. These sites, like email servers and banking websites, will require a code be sent to your phone number to be able to log in.

Encrypt sensitive data on your computer.

- This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS.gov[8]

Golf Tip

Tips for Golfing in the Winter

December is officially here, which means winter play is also here. If you’re planning on playing outside during the cold winter months, keep these tips in mind:

Your ball won’t fly as far in the cold, so be prepared to use more club than you might normally.

If you can, choose to walk instead of renting a cart. Walking is a great way to keep your body warm.

Play with two balls. Keep one warm in your pocket while you play the other one, and then switch them out every hole (just don’t artificially heat the ball).

Make sure to wear multiple layers to stay warm and take off layers as needed when you start to warm up.

Softer balls will fly farther in the cold weather, so shop for balls that compress more than the harder ones you would use in the summer.

Playing in the winter can be just as fun as playing in the summer. On many courses, the fairways will be less crowded, and you can take your time.

Tip adapted from Leading Courses[9]

Healthy Lifestyle

It’s Okay to Say No

With all the family gatherings, company holiday parties, and obligations every weekend, the holidays are exciting, yet exhausting. But believe it or not, it’s okay to say no. This time of year, it’s more important than ever to take time for self-care. In fact, learning how to respectfully say no is one important part of self-care.

There’s a difference between being agreeable and too agreeable. If you find yourself saying yes to things you don’t have time to do, and continually putting yourself last, it might be good to take some time for yourself. Make sure to set healthy boundaries and politely decline invitations if it’s too much for you. Don’t feel bad about wanting to stay home and read a good book, take a warm bath, or meditate. Don’t let the holidays overwhelm you, both mentally and physically. Taking time for yourself will benefit both!

Tip adapted from Rewire Me[10]

Green Living

Have an Eco-Friendly Holiday

There are many ways to save resources during the holidays and save the planet! Here are some of our favorite tips:

Make your own wrapping paper or reuse gift bags. Most wrapping paper isn’t recyclable because it has glitter, shiny patterns, and foils. Look for recyclable paper or use things like butcher paper or decorated newspaper.

Buy energy-saving LED holiday lights. LED lights use 90% less energy, which means you save money and natural resources.

Get a pesticide-free tree. Many Christmas tree lots grow pesticide-free or organic trees. Even more, look for trees that you can plant in your yard or a nearby park after the holiday.

Shop small and support local businesses. Not only will you be making a difference in the lives of an individual or family, but these sellers usually rely less on the many forms of transportation that big box retailers use. Some DIY gifts even reuse materials, making them even more environmentally friendly.

Tip adapted from Small Footprint Family[11]

Share the Wealth of Knowledge!

Please share this market update with family, friends, or colleagues. If you would like us to add them to our list, simply click on the sharing buttons below. We love being introduced!

Disclosures

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Diversification does not guarantee profit nor is it guaranteed to protect assets.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. The DJIA was invented by Charles Dow back in 1896.

The Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of stocks of technology companies and growth companies.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indices from Europe, Australia, and Southeast Asia.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

These are the views of Platinum Advisor Strategies, LLC, and not necessarily those of the named representative,

Broker dealer or Investment Advisor and should not be construed as investment advice. Neither the named representative nor the named Broker dealer or Investment Advisor gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

Resources

By clicking on these links, you will leave our server, as the links are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

[1] www.wsj.com/market-data

[2] quotes.wsj.com/index/XX/990300/historical-prices

[3] www.politico.com/news/2019/11/27/us-trade-deal-china-074230

[4] www.cnbc.com/2019/11/29/dow-futures-black-friday-thanksgiving-holiday.html

[5] www.morningstar.com/news/dow-jones/201911276898/us-gdp-growth-revised-up-to-21-rate-in-third-quarter-2nd-update

[6] www.briefing.com/calendars/economic/display-article?ArticleId=ER20191126100000ConsumerConfidence&FileName=conf.htm

[7] www.spoonforkbacon.com/brown-butter-cinnamon-rolls/

[8] www.irs.gov/newsroom/follow-these-tips-to-protect-data-when-shopping-online

[9] www.leadingcourses.com/blog/winter-golf-10-simple-tips/

[10] www.rewireme.com/happiness/okay-say-no/

[11] www.smallfootprintfamily.com/eco-friendly-holiday-tips