The Week on Wall Street

The shortened week, which began with a powerful two-day rally of trading, was enough to drive the markets into another week of solid gains.

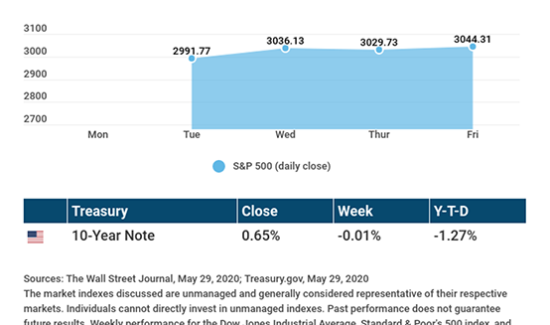

The Dow Jones Industrial Average rose 3.75%, while the Standard & Poor’s 500 advanced 3.01%. The Nasdaq Composite Index climbed 1.77% for the week. The MSCI EAFE Index, which tracks developed stock markets overseas, gained 6.18%.[1][2][3]

Rising Optimism

Returning from Memorial Day weekend, stocks surged on rising optimism over economic re-opening, declines in new infections, and progress in the development of a vaccine.

Stocks continued their march higher, lifted by signs that the White House and Congress may be working together to put together another stimulus package. But the momentum lost steam, in part due to news of China’s vote to override Hong Kong’s autonomy. Comments by President Trump on the last day of trading eased concerns.[4][5]

Rotation in Leadership

The recovery from the March lows has been powered by large-cap growth stocks, especially the mega-cap technology names. However, this week saw new sectors leading the market higher, notably the financials and industrials, while the technology and health care sectors lagged.

This leadership rotation is being referred to by some market commentators as the “re-opening trade.” If these sectors are to remain leaders, it may hinge on a steady economic recovery and escaping a second wave of COVID-19 infections.

THIS WEEK: KEY ECONOMIC DATA

Monday: Purchasing Managers Manufacturing Index (PMI). Institute for Supply Management (ISM) Manufacturing Index.

Wednesday: Automated Data Processing (ADP) Employment Report. PMI Services Index. ISM Non-Manufacturing Index.

Thursday: Jobless Claims.

Friday: Employment Situation Report.

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THIS WEEK: COMPANIES REPORTING EARNINGS

Tuesday: Dick’s Sporting Goods (DKS), Tiffany (TIF), Zoom Video (ZM), Crowdstrike (CRWD)

Wednesday: Cloudera (CLDR), Campbell Soup (CPB)

Thursday: Broadcom (AVGO), Docusign (DOCU), Slack Technologies (WORK)

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

Quote Of The Week

A surplus of effort could overcome a deficit of confidence.”

Sonia Sotomayor, Associate Justice of the Supreme Court of the United States

Recipe Of The Week

Salad Rolls

Serves 8

Ingredients:

- 1 8-oz. package rice vermicelli

- 8 oz. shrimp; cooked, peeled, and cut in half, lengthwise

- 8 rice wrappers (6½ in.)

- 1 carrot, finely grated

- 1 cup lettuce, shredded

- ¼ cup chopped fresh basil

- Water

Directions:

- Bring water to a boil in a medium-sized saucepan.

- Remove saucepan from heat and add vermicelli to water. Let it soak for 3 to 5 minutes.

- Drain and rinse with cold water.

- Dip one rice wrapper in a large bowl of hot water to soften.

- Lay the wrapper flat, then place noodles, shrimp, carrot, lettuce, and basil in the center.

- Tightly wrap ingredients.

- Repeat with remaining ingredients and wrappers.

- Serve with chili sauce.

Recipe adapted from AllRecipes.com[6]

Tax Tips

Tips for the “Gig” Economy

Do you rent a spare room in your house or provide car rides for a fee? If so, you may be a part of the sharing or “gig” economy. If you made any income from such platforms, you have some key financial details to address when filing your taxes.

Is the income taxable?

Yes. No matter whether you made money full or part time, the IRS taxes the income you make.

Can you take deductions?

Some business-expenses deductions may apply for taxpayers who qualify. A deduction for a business expense could be an item, such as claiming the standard mileage rate if you use your car for business.

Do taxes apply if you rent a home you also live in?

You will generally have to account for specific tax rules if you rent a home that you live in at any point throughout the year. You can identify the status of taxable rental income using the IRS tax assistant tool.

*This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS.gov[7]

Golf Tip

When to Putt with a Sand Wedge

Back in the 1970s, the great Lee Trevino introduced the sand wedge putt. Today, this unorthodox shot can rescue you from a pesky greenside lie.

When your ball is backed up against the fringe, or in some thick grass just off the edge of a slick putting surface, you may want or need to putt rather than chip, but you may also be worried about flubbing a putt. So, putt the ball onto the green using the thick leading edge of a sand wedge. This will give the ball a burst of initial topspin, more so than a typical putter, and the thick flange of the sand wedge has less chance of getting caught up in long grass or an outer cut of fringe.

Tip adapted from Shark.com[8]

Healthy Lifestyle

June Is Men’s Health Month

Today, June 1, marks the first day of Men’s Health Month. This health initiative was created by a Congressional health education program in 1994, to further awareness of the importance of early intervention and prevention of common diseases that can affect men during all stages of life. Just keep in mind: a conversation with your doctor is always the best way to address any health concerns you may have; this tip isn’t a substitute for medical advice.

Throughout the month, community outreach events, like health fairs, screenings, and educational seminars, bring awareness to concerns like prostate cancer, heart disease, and hypertension, among others. Information about healthy living, exercise, diet, smoking cessation, and other general wellness tips may be shared as well.

Look out for men’s health activities and functions in your area. You might just learn something new!

Tip adapted from MensHealthMonth.org[9]

Green Living

Supplement Your Soil with Coffee Grounds

Does your yard have plants that thrive in acidic soil? Take your old, used coffee grounds, and mix them into the soil to give it a healthy boost. In fact, you can create a blend of up to 50% soil and 50% coffee grounds to help nourish plants that love acidic soil.

Before you go dumping your used coffee filters into your garden, note that “acidic” is the keyword. Types of plants that thrive in acidic soil and would love a coffee ground snack include azaleas, gardenias, blueberry bushes, dogwood trees, holly bushes, and roses. Other plants that require a more basic soil composition will die off with this mixture.

Tip adapted from The Spruce[10]

Share the Wealth of Knowledge!

Please share this market update with family, friends, or colleagues. If you would like us to add them to our list, simply click on the sharing buttons below. We love being introduced!

Share the Wealth of Knowledge!

Please share this market update with family, friends, or colleagues. If you would like us to add them to our list, simply use one of the sharing buttons below. We love being introduced!

Disclosures

<small>Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Diversification does not guarantee profit nor is it guaranteed to protect assets.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. The DJIA was invented by Charles Dow back in 1896.

The Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of stocks of technology companies and growth companies.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indices from Europe, Australia, and Southeast Asia.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

These are the views of Platinum Advisor Strategies, LLC, and not necessarily those of the named representative,

Broker dealer or Investment Advisor and should not be construed as investment advice. Neither the named representative nor the named Broker dealer or Investment Advisor gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial professional for further information.Resources

By clicking on these links, you will leave our server, as the links are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

The market indexes discussed are unmanaged and generally considered representative of their respective markets. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.[1] The Wall Street Journal, January 8, 2021

<br />

[2] The Wall Street Journal, January 8, 2021

<br />

[3] The Wall Street Journal, January 8, 2021

<br />

[4] The Wall Street Journal, January 6, 2021

<br />

[5] CNBC, January 8, 2021

<br />

[6] The Wall Street Journal, January 8, 2021

<br />

[7] The Wall Street Journal, January 8, 2021

<br />

[8] KitchenConfidante.com, January 8, 2021

<br />

[9] IRS.gov, January 8, 2021

<br />

[10] YourTahoePlace.com, January 8, 2021

<br />

[11] CDC.gov, September 25, 2020

<br />

[12] TheSpruce.com, October 12, 2019</small>[2] The Wall Street Journal, May 29, 2020

[3] The Wall Street Journal, May 29, 2020

[4] CNBC.com, May 28, 2020

[5] FoxBusiness.com, May 29, 2020

[6] AllRecipes.com, May 29, 2020

[7] IRS.gov, February 25, 2020

[8] Shark.com, May 29, 2020

[9] MensHealthMonth.org, May 29, 2020

[10] TheSpruce.com, May 29, 2020