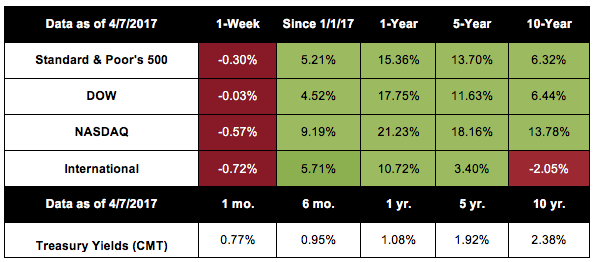

The first quarter of 2017 is now behind us, and although we won’t have complete economic data for a while, we do know that domestic stocks had a solid start to the year. Last week, major indexes took a pause from some recent gains and began the second quarter of 2017 with less than thrilling performance. The S&P 500 lost 0.30%, the Dow was down 0.03%, the NASDAQ gave back 0.57%, and the MSCI EAFE declined 0.72%.[1] For this week’s update, we’re going to examine what happened to markets in the first quarter.

How did markets perform in Q1?

All three major domestic indexes posted sizable gains in the first three months of 2017:[2]

S&P 500 up 5.5%

Dow up 4.6%

NASDAQ up 9.8%

As we mentioned last week, the NASDAQ’s nearly double-digit growth represented its best quarter since 2013.[3]

However, the majority of the markets’ gains happened in January and February.[4] While the NASDAQ increased 1.48% in March, the S&P 500 stayed flat and the Dow lost 0.72% in the same period.[5]

Which stocks outperformed in Q1?

Large cap stocks – companies with more than $5 billion in market capitalization – drove much of the growth we saw last quarter.[6] Tech stocks performed especially well, gaining more than 12% over the quarter.[7] In fact, S&P Info Tech, which tracks information technology stocks in the S&P 500, was the quarter’s highest performing sector index.[8]

How did politics affect market performance in Q1?

As the new presidential administration came to power last quarter, investors closely followed policy news and headlines. We encourage you to pay more attention to economic fundamentals than media reports, but we understand that completely ignoring political conversations would have been challenging in Q1.

Overall, investor expectations for the new administration’s pro-growth policies helped push the markets to numerous record highs last quarter.[9] However, when Congress chose not to vote on the American Health Care Act, market concerns increased about whether new policy changes would actually occur.[10] The Dow lost 317 points the week of the expected – but cancelled – healthcare vote.[11]

How high was volatility in Q1?

Even though policy debates have seemed to heighten the emotional landscape this year, the VIX measure of volatility recorded its lowest Q1 average ever.[12] The 11.69 level is also the second lowest quarterly average since 1990.[13]

What might be on the horizon?

Earnings season is upon us, and investors will be watching to see whether reports match expectations. According to FactSet, the S&P 500’s estimated earnings growth rate for Q1 2017 is 8.9% – which would be its best year-over-year earnings growth since 2013.[14] Only a handful of S&P 500 companies have reported their earnings so far; of these reports, 57% exceeded the mean sales estimate and 74% exceeded the mean earnings-per-share estimate.[15]

In addition to earnings, the Federal Reserve’s interest-rate decisions will be on many people’s minds throughout 2017. After raising rates on March 15, the Fed expects at least two more increases this year.[16] So far, the markets absorbed these increases well, with the Dow even gaining 100 points on the Fed’s last meeting day.[17]

Ultimately, we have many data points, policy updates, and economic indicators to focus on in the coming months. As of now, 2017 has started with strong market performance, high consumer confidence, and low volatility.[18]

ECONOMIC CALENDAR

Tuesday: JOLTS

Wednesday: Import and Export Prices, EIA Petroleum Status Report

Thursday: PPI-FD, Consumer Sentiment

Friday: Consumer Price Index, Retail Sales, Business Inventories

Quote Of The Week

“Things don’t just happen; they are made to happen.” – John F. Kennedy

Recipe Of The Week

Cherry Nut Granola

Boost your breakfast with this easy, homemade cereal!

Servings: Makes about 5 cups

Ingredients:

¼ cup apple juice

3 tablespoons honey

2 tablespoons light brown sugar, packed

1 tablespoon canola oil or other preferred cooking oil

1 teaspoon pure vanilla extract

1 teaspoon ground cinnamon

¼ teaspoon salt

3 cups rolled oats

½ cup almonds, chopped coarsely

½ cup pecans, chopped coarsely

½ cup dried cherries

¼ cup dried currants

Directions:

Set oven to preheat at 350°F.

Combine the apple juice, honey, brown sugar, oil, vanilla, cinnamon, and salt in a large bowl.

Whisk ingredients together.

Add oats, almonds, and pecans to mixture.

Toss all ingredients until they combine well and become thoroughly moistened.

Take out 2 baking sheets and divide mixture between them.

Place sheets in oven and bake until granola turns a light golden brown (roughly 15 – 18 minutes). Shake the pans occasionally as they bake.

Remove baked granola from oven and pour into a large bowl.

Add cherries and currants.

Cool granola completely and store in airtight container for up to 1 week.

Recipe adapted from Martha Stewart.com[19]

Tax Tips

Claiming Employee Business Expenses

As an employee, you may end up making out-of-pocket purchases to support your workplace responsibilities. When you do so, you may be able to deduct some expenses. Here is further guidance to help you manage employee business expense claims.

Is there any limit on how much you can claim?

Typically, yes. You’re able to deduct employee business expenses that total more than 2% of your adjusted gross income.

Are all expenses deductible?

No. The IRS has rules for the type of employee business expenses you can claim. The expenses must meet two criteria for your workplace responsibilities: be ordinary and necessary.

Ordinary: an expense that your industry identifies as common and accepted

Necessary: an appropriate expense that also helps the business

What are common expense examples?

The below list represents a sample of expenses that you can typically deduct and meet the “ordinary” and “necessary” requirements:

Any clothes or uniforms you must wear at work and not for everyday use.

Any tools or supplies you need to do your job.

Education that supports your role at work.

Travel for work that takes you away from your home.

To claim your expenses, you will need to file Form 2106, Form 2106-EZ, or IRS Schedule A. You can find further information on the IRS website.

*This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.

Tip courtesy of IRS.gov[20]

Golf Tip

Miss the Box and Stop Pop-Ups

When you’re driving the ball, is your angle of attack too steep? If so, you may be sacrificing distance and creating those awful pop-ups everyone wants to avoid.

Unlike other clubs that require shallower angles of attack as the shaft gets longer, with a driver, hitting up on the ball is a good idea. However, players often let the driver head get too far in front of the ball before making contact. You can beat this bad habit with a surprisingly simple tool: a ball sleeve.

To do so:

Place a ball sleeve 12 inches in front of your ball.

Aim to create an upward angle of attack as you swing while completely missing the ball sleeve.

Angle your head so it leans backward behind the ball, which enables you to create a shallower attack and ascend into the ball.

After trying this technique, you should find that you hit the ball farther and harder – and avoid those annoying pop-ups.

Tip courtesy of Golf Tips Magazine[21]

Healthy Lifestyle

Manage and Prevent Migraines

Migraines can make life challenging, as the debilitating pain keeps you from being able to do simple things, like even opening your eyes. For those who suffer from migraines, a variety of medications are available to help control the problem. However, you can take your care a step further by making some life changes that may help you lessen their frequency and intensity.

Create a Regular Sleep Schedule: Going to bed at different times each night and for different lengths can trigger headaches. You can help avoid this effect by creating and sticking to a consistent sleep schedule, even during weekends and holidays.

Get Frequent Exercise: Studies suggests that those who get regular, moderate aerobic exercise can decrease frequency, length, and intensity of their migraines.

Don’t Skip Meals: Regularly eating will help avoid drops in your blood sugar, which can trigger headaches. You’ll also want to stay hydrated.

Get Complementary Care: Treatments such as massage, acupuncture, and talk therapy can deepen your care and work alongside your lifestyle changes and medications.

Tip courtesy of Mayo Clinic[22]

Green Living

Ways to Minimize Waste at Home

Minimizing the waste you produce starts with minimizing your consumption. While some people choose to go all the way to a near “zero waste home” – where they live in a manner that doesn’t produce any extra waste – you don’t have to take such extreme measures in order to go green. Here are a few ways you can reduce waste in your home and create happier families (and landfills).

Eliminate Disposables: Products like plastic sandwich bags and paper towels may be convenient, but they add to the waste you produce. You can swap your disposable items for durable alternatives, such as stainless containers for sandwich bags and washable rags for paper ones.

Give Life to Leftovers: Food waste is a big problem, and you can decrease this in your home by choosing to reinvent your leftovers into new meals instead of tossing them.

Buy in Bulk: Rather than purchasing small quantities – and taking home new containers each time – start buying household items in bulk. At certain stores you can find bulk options for everything from food items like nuts and beans to household products like shampoo and conditioner.

Tip courtesy of Zero Waste Home[23]

Share the Wealth of Knowledge!

Please share this market update with family, friends, or colleagues. We love being introduced!

Disclosures

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Diversification does not guarantee profit nor is it guaranteed to protect assets.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. The DJIA was invented by Charles Dow back in 1896.

The Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of stocks of technology companies and growth companies.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indices from Europe, Australia and Southeast Asia.

The S&P/Case-Shiller Home Price Indices are the leading measures of U.S. residential real estate prices, tracking changes in the value of residential real estate. The index is made up of measures of real estate prices in 20 cities and weighted to produce the index.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

Featured Image Notes: All index returns exclude reinvested dividends, and the 5-year and 10-year returns are annualized. Sources: Yahoo! Finance, S&P Dow Jones Indices and Treasury.gov. International performance is represented by the MSCI EAFE Index. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

These are the views of Platinum Advisor Marketing Strategies, LLC, and not necessarily those of the named representative, Broker dealer or Investment Advisor, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer or Investment Advisor gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

Resources

By clicking on these links, you will leave our server, as they are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

[1] http://finance.yahoo.com/quote/%5EGSPC/history?period1=1490932800&period2=1491537600&interval=1d&filter=history&frequency=1d

http://finance.yahoo.com/quote/%5EDJI/history?period1=1490932800&period2=1491537600&interval=1d&filter=history&frequency=1d

http://finance.yahoo.com/quote/%5EIXIC/history?period1=1490932800&period2=1491537600&interval=1d&filter=history&frequency=1d

https://www.msci.com/end-of-day-data-search

[2] http://business.nasdaq.com/marketinsite/2017/MID-April/MID-Special-Update-First-Quarter-2017-Review-Look-Ahead.html

[3] http://www.cnbc.com/2017/03/31/us-markets.html

[4] http://www.cnbc.com/2017/03/31/us-markets.html

[5] http://www.cnbc.com/2017/02/17/us-markets.html

http://www.cnbc.com/2017/03/31/us-markets.html

[6] http://www.investopedia.com/terms/l/large-cap.asp

http://business.nasdaq.com/marketinsite/2017/MID-April/MID-Special-Update-First-Quarter-2017-Review-Look-Ahead.html

[7] http://www.cnbc.com/2017/03/31/us-markets.html

[8] http://business.nasdaq.com/marketinsite/2017/MID-April/MID-Special-Update-First-Quarter-2017-Review-Look-Ahead.html

[9] http://www.cnbc.com/2017/03/31/us-markets.html

[10] https://www.zacks.com/stock/news/255250/apple-amp-these-3-stocks-were-best-performers-of-q1

[11] http://business.nasdaq.com/marketinsite/2017/MID-April/MID-Special-Update-First-Quarter-2017-Review-Look-Ahead.html

[12] http://www.zerohedge.com/news/2017-04-03/goldman-warns-risk-underpriced-amid-lowest-q1-vix-level-record

[13] http://www.zerohedge.com/news/2017-04-03/goldman-warns-risk-underpriced-amid-lowest-q1-vix-level-record

[14] https://insight.factset.com/hubfs/Resources/Research%20Desk/Earnings%20Insight/EarningsInsight_040717.pdf

[15] https://insight.factset.com/hubfs/Resources/Research%20Desk/Earnings%20Insight/EarningsInsight_040717.pdf

[16] https://www.nytimes.com/2017/03/15/business/economy/fed-interest-rates-yellen.html?_r=0

[17] http://business.nasdaq.com/marketinsite/2017/MID-April/MID-Special-Update-First-Quarter-2017-Review-Look-Ahead.html

[18] http://finance.yahoo.com/news/comes-consumer-confidence-133841167.html

[19] http://www.marthastewart.com/316640/cherry-nut-granola

[20] https://www.irs.gov/uac/know-these-helpful-tips-about-employee-business-expenses

[21] http://www.golftipsmag.com/instruction/quick-tips/miss-the-box-2/

[22] http://www.webmd.com/migraines-headaches/guide/understanding-migraine-prevention#2

[23] http://www.zerowastehome.com/about/tips/