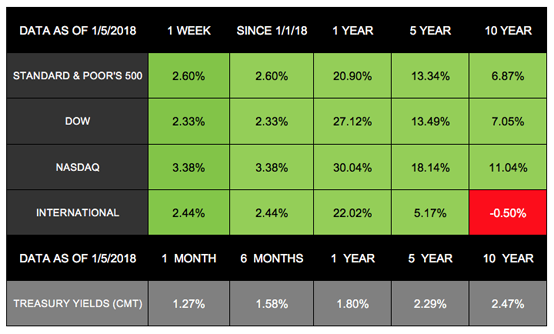

The first week of 2018 is behind us, and across the globe, stocks experienced a strong start to the year. International stocks in the MSCI EAFE gained 2.44% last week.[1] In the U.S., our major indexes also leapt forward, hitting a number of records and milestones.[2]

Domestic Index Performance for the First Week of 2018[3]

S&P 500:

* Gained 2.60%

* Hit 2,700 for the first time

* Posted its largest weekly gain since December 2016

Dow:

* Gained 2.33%

* Hit 25,000 for the first time

* Had its best yearly start since 2006

NASDAQ:

* Gained 3.38%

* Hit 7,000 for the first time

* Posted its largest weekly gain since December 2016

* Had its best yearly start since 2006

What drove markets last week?

A variety of factors affected the markets last week – from tax reform to commodity prices.[4] Interestingly, considering the indexes’ positive performance, one of the biggest economic headlines seemed to provide negative data: The U.S. economy added fewer jobs than anticipated.[5]

On the surface, this report may seem like bad news for the economy. The missed projection, however, is likely less of a big deal than it appears at first. While hiring was lower than expected, wages picked up and the unemployment rate remained at 4.1% – the lowest rate since 2000.[6]

Ultimately, this jobs report may be positive news for the markets. It shows that the economy is still adding jobs but not at a blistering pace. As a result, slower job growth could keep the Federal Reserve from raising interest rates too aggressively. Cleveland Fed President Loretta Mester said she believes, “We’re basically at maximum employment from the view of monetary policy.” She anticipates 3 to 4 rate increases this year.[7] If the Fed continues with its gradual rate increases, this move could have a favorable affect on stocks.[8]

As we move forward in 2018, we will continue monitoring a myriad of economic perspectives that may impact you, including any changes to monetary policy. For now, we are pleased to see the markets’ positive start to the year and look forward to guiding you through whatever lies ahead.

ECONOMIC CALENDAR

Tuesday: JOLTS

Thursday: Jobless Claims

Friday: Consumer Price Index, Retail Sales

Quote Of The Week

“The only person you’re destined to become

is the person you decide to be.”– Ralph Waldo Emerson

Recipe Of The Week

Bacon and Broccoli Rice Bowl

Serves 4

Ingredients:

2 cups white rice, short grain or sushi

6 slices bacon, chopped

1 broccoli head, florets chopped and stems peeled and sliced

3¼ cups water

2 tablespoons soy sauce, low-sodium

1½ teaspoons sesame oil

4 eggs, large

Kosher salt

3 tablespoons fresh cilantro, chopped

2 scallions, sliced

2 tablespoons pickled jalapenos, chopped

Directions:

Rice

1. Place rice in 2½ cups water, and bring to a boil over medium-high heat.

2. Cover pot with lid and simmer over medium heat until rice absorbs most of the water (about 6 minutes).

3. Turn heat to low, and continue cooking rice for 12 minutes.

4. Remove cooked rice from heat and let stand, covered.

Bacon

5. Cook bacon pieces over medium heat until crispy (about 10 minutes).

6. Remove bacon from pan and place on plate lined with a paper towel.

7. Pour out all but 1 tablespoon of the bacon grease.

Broccoli

8. Heat pan with bacon grease over medium-high. Toss in broccoli, and sauté until florets slightly char.

9. Pour in ¾ cups water, and simmer until broccoli is al dente with a few tablespoons of water left in the pan.

10. Add soy sauce and ½ teaspoon sesame oil.

11. Serve rice and broccoli in bowls, and top with juices from cooking.

Egg

12. Warm 1 tablespoon sesame oil over medium heat in same pan.

13. Crack all the eggs into the pan, sprinkle with salt, and fry to desired firmness.

14. Remove cooked eggs, and place 1 in each bowl over rice and broccoli.

15. Garnish dish with bacon, cilantro, scallions, and jalapenos.

Recipe adapted from Food Network[9]

Tax Tips

Tax Details for the Sharing Economy*

If you participate in the sharing economy, you use websites or apps to provide services, such as renting your house for guests. Doing so may require you to address specific tax details for your income. Here are some key items to be aware of as you manage your tax liabilities:

Taxable Income

You generally have to pay federal taxes when you receive income from any of the following:

Part-time work

Side business

Cash payments

Form 1099 or W-2 money

Specific Tax Items for Rented Homes

If you rent any part of a home that you live in for a duration of the year, you may need to address additional tax details. You can find more information in the IRS Publication 527, Residential Rental Property (Including Rental of Vacation Homes).

Other details may apply, and you can find more information on the IRS website.

* This information is not intended to be a substitute for specific individualized tax advice. We suggest you discuss your specific tax issues with a qualified tax advisor.

Tip courtesy of IRS.gov[10]

Golf Tip

Improve Your Balance for Better Play

Good balance is crucial in golf, due to the game’s rotational athletic nature. You must manage a strong accelerated force while transferring energy from the club to your ball at exactly the right time. If your balance is off, your shot will be, too.

You can practice with the “Bucket Brigade Drill.”

Fill a small bucket with water (but not completely full).

Stand with your feet apart under your shoulders, extend your arms, and hold the bucket in front of you.

Focus on a target (perhaps a picture frame if inside or a tree trunk if outside).

Make sure you are “Parallel Left” (or “Parallel Right” for left-handed players) of your target. Keep your arms, legs, shoulders, and feet still as you focus.

Turn toward your target, using only your feet, legs, and core. Keep your arms extended in front of you. Your goal is to make this move without spilling any water.

Hold this position for 5 seconds, paying close attention to the feel of your body and the setup.

Repeat this move multiple times on each side.

This technique will help you practice your setup while building muscle strength, which is essential for balance in any swing.

Tip adapted from John Hughes | Golf Tips Magazine[11]

Healthy Lifestyle

Identify Frostbite and Hypothermia

Winter often brings bitter cold across the country, and so far, 2018 is off to quite a chilly start. If you enjoy exercising or participate in outdoor activities, staying warm is essential. Here are some signs to help you recognize frostbite and hypothermia:

Frostbite

Frostbite occurs when the body starts freezing and most commonly affects exposed skin, such as fingers, cheeks, and noses. Here are signs to look for:

Numbness

Loss of feeling

Stinging sensations

If you suspect you have frostbite, slowly warm the affected area. Avoid rubbing your skin, which can cause serious damage.

Hypothermia

When your body temperature drops to abnormally low levels due to cold exposure, hypothermia may set in. These extreme conditions can cause your body to lose heat faster than it can generate warmth. If you suspect any of the following signs, seek emergency help immediately:

Intense shivering

Slurring speech

Coordination loss

Fatigue

Consult your doctor to learn more about potential risks when exercising outside during cold weather.

Tip adapted from Mayo Clinic[12]

Green Living

Foods With High Carbon Footprints

The foods we eat can negatively affect our environment. For example, agriculture is one of the largest contributors of harmful gases like carbon monoxide and methane. Here is a quick guide on some common foods that have the highest carbon footprints:

Meats

Livestock creates 51% of the world’s greenhouse gases. Here are the top meats (in order): lamb, beef, pork, and farmed salmon.

Produce

Plant-based foods can also harm the environment, mostly due to shipping produce around the world that only grows in warm climates. The top plant contributors include (in order): potatoes, asparagus, avocados, bananas and eggplant.

Tip adapted from Care2.com[13]

Share the Wealth of Knowledge!

Please share this market update with family, friends, or colleagues. We love being introduced!

Disclosures

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Diversification does not guarantee profit nor is it guaranteed to protect assets.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. The DJIA was invented by Charles Dow back in 1896.

The Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of stocks of technology companies and growth companies.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indices from Europe, Australia and Southeast Asia.

The S&P/Case-Shiller Home Price Indices are the leading measures of U.S. residential real estate prices, tracking changes in the value of residential real estate. The index is made up of measures of real estate prices in 20 cities and weighted to produce the index.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

Featured Image Notes: All index returns (except S&P 500) exclude reinvested dividends, and the 5-year and 10-year returns are annualized. The total returns for the S&P 500 assume reinvestment of dividends on the last day of the month. This may account for differences between the index returns published on Morningstar.com and the index returns published elsewhere. International performance is represented by the MSCI EAFE Index. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

These are the views of Platinum Advisor Marketing Strategies, LLC, and not necessarily those of the named representative, Broker dealer or Investment Advisor, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer or Investment Advisor gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

Resources

By clicking on these links, you will leave our server, as they are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

[1] www.msci.com/end-of-day-data-search

[2] www.bloomberg.com/news/articles/2018-01-04/asia-stocks-poised-to-extend-torrid-start-to-2018-markets-wrap

[3] www.cnbc.com/01/05/us-stock-futures-us-jobs-dow-politics-on-the-agenda.html

http://performance.morningstar.com/Performance/index-c/performance-return.action?t=SPX®ion=usa&culture=en-US

http://performance.morningstar.com/Performance/index-c/performance-return.action?t=%21DJI®ion=usa&culture=en-US

http://performance.morningstar.com/Performance/index-c/performance-return.action?t=@CCO

[4] www.marketwatch.com/story/sp-eyes-another-historic-record-run-with-us-jobs-data-on-deck-2018-01-05

[5] www.bloomberg.com/news/articles/2018-01-04/asia-stocks-poised-to-extend-torrid-start-to-2018-markets-wrap

[6] www.bloomberg.com/news/articles/2018-01-05/u-s-adds-148-000-jobs-wages-rise-in-signs-of-full-employment

[7] www.marketwatch.com/story/sp-eyes-another-historic-record-run-with-us-jobs-data-on-deck-2018-01-05

[8] finance.yahoo.com/news/futures-trim-gains-december-jobs-134147154.html

[9] www.foodnetwork.com/recipes/food-network-kitchen/bacon-and-broccoli-rice-bowl-recipe-2120232

[10] www.irs.gov/newsroom/participating-in-the-sharing-economy-can-affect-taxes

[11] www.golftipsmag.com/instruction/full-swing/big-golf-balance-act/

[12] www.mayoclinic.org/healthy-lifestyle/fitness/in-depth/fitness/art-20045626

[13] www.care2.com/greenliving/5-foods-with-huge-carbon-footprints.html