Last week, the East Coast prepared for Hurricane Florence, which roared through the Carolinas and Georgia. As investors kept their eyes on the weather and its potential for destruction, estimates emerged of up to $27 billion in hurricane damage. This potential for damage contributed to insurance companies in the S&P 500 declining last week.[1] While the hurricane likely won’t have a large effect on our economy, its destruction could influence data for months to come.[2]

Meanwhile, last week brought another milestone in our economy: the 10th anniversary of Lehman Brothers’ bankruptcy.

For 158 years, the Wall Street firm weathered the markets’ changes. By 2008, however, various challenges, including excessive risk taking, led to its demise. The firm’s unexpected bankruptcy announcement shocked investors and triggered market panic, leading what was a simmering financial crisis to become the Great Recession. A decade later, the markets are on more solid ground, and banks hold more capital and have stronger regulation. While some professionals or analysts warn of a potential looming recession, current market performance and economic data indicate just how far we’ve come.[3]

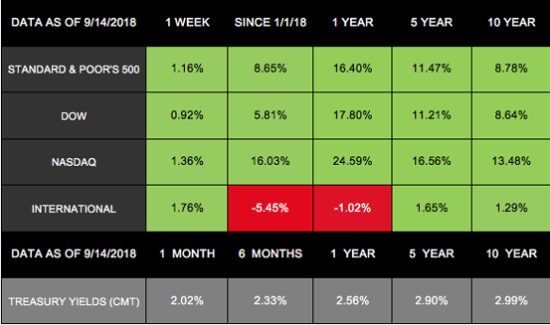

Let’s examine last week’s data to understand examples of where we are today: Domestic indexes rebounded to post healthy gains for the week, with the S&P 500 adding 1.16%, the Dow gaining 0.92%, and the NASDAQ increasing 1.36%.[4] International stocks in the MSCI EAFE were also up, gaining 1.76%.[5]

In addition, we received the following updates, which support a picture of a more robust economy:

Consumer sentiment jumped: The September reading was at its 2nd-highest point since 2004. The data reveals that consumers expect the economy to grow and create more jobs.[6]

Retail sales stalled but are primed for growth: Spending barely increased in August, after months of strong growth. However, analysts believe this data is “a blip” rather than an emerging trend, as tax cuts and a healthy labor market leave Americans with money in their pockets.[7]

Industrial production rose for the 3rd-straight month: Auto manufacturing contributed to higher than expected industrial production in August. For now, trade tensions have not yet hurt this sector.[8]

These data reports may not show blockbuster growth, but together they indicate our economy is doing well. In fact, they were strong enough to lead many economists and analysts to increase their projections of how fast the economy expanded during the 3rd quarter.[9]

Looking back, the markets have come far from where they were 10 years ago. But risks will always remain, as Hurricane Florence and Lehman Brothers remind us. Today and in the future, we are here to help you understand where you are and plan for whatever may lie ahead.

Also, for those affected by the hurricane, we’re ready to support your recovery and provide the financial guidance you seek.

ECONOMIC CALENDAR

Tuesday: Housing Market Index

Wednesday: Housing Starts

Thursday: Existing Home Sales, Jobless Claims

Quote Of The Week

“Not everything that can be counted counts,

and not everything that counts can be counted.”– William Bruce Cameron

Recipe Of The Week

Roasted Cumin Shrimp and Asparagus

Serves 4

Ingredients:

1 cup couscous

1 navel orange

Kosher salt

Pepper

20 large shrimp, peeled and deveined

2 tablespoons olive oil

½ teaspoon ground cumin

¼ teaspoon cayenne

1 pound thin asparagus, trimmed

Directions:

Put couscous in a bowl. Pour on juice from half an orange and 1 cup of hot tap water. Keep covered for 15 minutes. For seasoning, add salt and pepper and mix gently.

At the same time, add cumin, cayenne, and salt to shrimp to season. Broil the shrimp with the asparagus mixed with oil and seasoned with salt and pepper, 2 minutes each side. Broil until shrimp is opaque throughout and asparagus is tender.

After squeezing the juice from the other half of the orange on the shrimp, serve with couscous.

Recipe adapted from Good Housekeeping[10]

Gray

Tax Tips

IRS Provides Businesses with Resources on Tax Reform*

Running a business in a complicated marketplace can pose quite a few challenges. In a constantly changing political climate, prospering-or even surviving-can get even more confounding.

Add into the mix changes in tax law, and you start to wonder where you can go to find some sound advice. How about the source?

To help businesses, the IRS makes available these resources:

The Tax Reform page provides highlights and updates on changes in tax laws. Go to https://www.irs.gov/tax-reform.

The agency regularly posts updates to its fact sheets. Go to https://www.irs.gov/newsroom/fact-sheets.

The IRS provides publications on the new tax law, the Tax Cuts and Jobs Act of 2017. Go to https://www.irs.gov/publications/p15.

The IRS has a section for frequently asked questions: https://www.irs.gov/newsroom/tax-reform-resources.

Business owners may subscribe to receive emailed tax reform tips: https://www.irs.gov/newsroom/subscribe-to-irs-tax-tips and https://www.irs.gov/businesses/small-businesses-self-employed/subscribe-to-e-news-for-small-businesses.

Other details may apply, and you can find more information on the IRS website.

* This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.

Tip adapted from IRS.gov[11]

Golf Tip

Flushing It Out of the Rough

Cue the Indiana Jones music. Your ball landed somewhere in the rough. Now you have to go in search of your lost ball.

Once you spot it, what do you do to get it out and back on the fairway?

Here are three steps to rescue your ball from the rough:

Choose your club wisely. If the green is still a ways away, use a higher-lofted fairway wood. The wider sole of the club allows you to cut through the grass more smoothly.

Next up, the address. The ball shouldn’t be any farther away than the center of your stance. Grip your club a little lower and put more pressure on your front foot.

Now the swing. Prepare to swing with your hands clutching the club so that the clubhead turns abruptly upward. This creates a sharper angle for contact.

Here’s a quick way to remember this process: Up and oomph. Up refers to the steeper takeaway and oomph refers to the aggressive downswing.

Tip adapted from GolfDigest[12]

Healthy Lifestyle

Kicking the Sugar Habit with a Detox?

Jackie Gleason may have made the phrase “How sweet it is” famous, but medical authorities are saying not so fast, especially in the form of added sugar.

America’s attraction to sweets may not be so healthy. Too high an intake of sugar may lead to a variety of ailments, such as heart disease, diabetes, and obesity.

Recognizing the dietary dangers, some sugarholics go to potentially unhealthy extremes to break their habits.

How about the trendy sugar detox? Will it help you break the habit? Let’s explore the sweet facts.

It’s true that some people crave sugar and use it in excess. But is it an addiction? Probably not. Is it unhealthy at high levels? Definitely.

Sugar fuels brain cells. And people often consume sugary foods as a reward, which tends to rewire your brain by reinforcing the habit.

Consuming sugar, which turns into simple carbohydrates, causes spikes in your blood sugar (glucose) levels.

Your body then works to remove the glucose from your blood. Your pancreas produces insulin. Your blood sugar then plunges, which produces sluggishness and the desire for more sugar to reacquire that sugar high. That leads to more eating. And more eating, naturally, tends to lead to obesity and other weight problems.

So, do detox diets work? Yes and no. Detox diets that remove all food items that may affect blood sugar-fruits, dairy, and refined grain-are too much of a shock on your body. Drastic dietary changes can send you soaring right back into sugar orbit.

What can you do?

Health experts recommend retraining your taste buds by initially eliminating one sugary item at a time. You may explore other “sweet” or healthy options such as berries or low-sugar yogurt.

Kick the habit one step at a time, experts advise. Adding more protein to your diet can also make the transition smoother.

Quitting or controlling the sugar habit may be a struggle at first, but you reap plenty of benefits: a healthier lifestyle, more energy, and weight loss.

Tips adapted from WebMD[13]

Green Living

Becoming More Environmentally Friendly While Doing

the Laundry

You may want to do your part to help save the planet and become more environmentally friendly, but how do you do it while doing the laundry?

The U.S. could save nearly 40 million gallons of water a year if households used efficient washers.

Here are some tips to get you thinking about saving the planet while doing the laundry:

Use cool water while rinsing. Washing and rinsing with hot water uses more than three times the energy than using cool water during rinsing.

The newer, more efficient washers use nearly four times less energy than the older machines. You can also save up to $70 a year in energy costs.

Lower your water heater’s temperature to 120ºF, which is sufficient for most of your laundry.

Do one big load rather than several smaller ones. But don’t overload your washer either.

Clean your dryer’s outside vents regularly.

Take your clothes out of the dryer slightly damp and hang them up. This reduces the need for ironing.

Tips adapted from EarthShare[14]

Share the Wealth of Knowledge!

Please share this market update with family, friends, or colleagues. We love being introduced!

Disclosures

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Diversification does not guarantee profit nor is it guaranteed to protect assets.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. The DJIA was invented by Charles Dow back in 1896.

The Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of stocks of technology companies and growth companies.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indices from Europe, Australia, and Southeast Asia.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

Featured Image Notes: All index returns (except S&P 500) exclude reinvested dividends, and the 5-year and 10-year returns are annualized. The total returns for the S&P 500 assume reinvestment of dividends on the last day of the month. This may account for differences between the index returns published on Morningstar.com and the index returns published elsewhere. International performance is represented by the MSCI EAFE Index. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

These are the views of Platinum Advisor Strategies, LLC, and not necessarily those of the named representative,Broker dealer or Investment Advisor, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer or Investment Advisor gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

Resources

By clicking on these links, you will leave our server, as the links are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

[1] fortune.com/2018/09/11/hurricane-florence-stock-market/

[2] www.bloomberg.com/news/articles/2018-09-12/florence-to-batter-u-s-data-but-harm-to-economy-likely-small

[3] money.cnn.com/2018/09/14/investing/lehman-brothers-2008-crisis/index.html

[4] http://performance.morningstar.com/Performance/index-c/performance-return.action?t=SPX®ion=usa&culture=en-US

http://performance.morningstar.com/Performance/index-c/performance-return.action?t=!DJI®ion=usa&culture=en-US

http://performance.morningstar.com/Performance/index-c/performance-return.action?t=@CCO

[5] www.msci.com/end-of-day-data-search

[6] www.cnbc.com/2018/09/14/september-consumer-sentiment.html

[7] www.marketwatch.com/story/retail-sales-grow-by-smallest-amount-in-six-months-but-spending-primed-to-rebound-2018-09-14

[8] www.marketwatch.com/story/us-industrial-production-up-for-third-straight-month-on-strength-in-autos-2018-09-14

[9] www.bloomberg.com/news/articles/2018-09-14/retail-sales-factory-output-signal-steady-u-s-economic-growth?srnd=markets-vp

[10] www.goodhousekeeping.com/food-recipes/easy/a19854680/roasted-cumin-shrimp-and-asparagus-recipe/

[11] www.irs.gov/newsroom/business-owners-can-visit-irsgov-for-resources-to-help-understand-tax-reform

[12] www.golfdigest.com/story/flush-it-from-the-rough

[13] www.webmd.com/diet/ss/slideshow-sugar-addiction

[14] www.earthshare.org/turn-your-whole/